I. Introduction

Hello there! If you’ve been dazzled by the allure of the Lion City and are considering purchasing a property in Singapore, you’ve come to the right place. The city-state’s real estate market is vibrant and dynamic, but it’s crucial for foreign buyers to understand the rules and regulations. Let’s dive right in!

II. Overview of Singapore's Property Ownership Laws

In the past, Singapore’s property laws have undergone several transformations. Currently, the Residential Property Act serves as the primary regulation on foreign ownership, which we’ll delve into later. For now, suffice it to say, yes, foreigners can own property in Singapore—but with some conditions.

III. Who is Considered a Foreigner in Singapore?

In Singapore’s legal context, a foreigner is anyone who is not a Singapore citizen or a Permanent Resident (PR). The rules for PRs and citizens are different, so if you’re not in either of these categories, read on!

IV. Types of Properties that a Foreigner Can Buy in Singapore

- Condominiums and Private Apartments: As a foreigner, you're free to buy apartments in building complexes without needing to seek government approval. This makes condos and private apartments a popular choice for foreign buyers.

- Landed Property in Sentosa Cove: Here's a unique enclave where foreigners can buy a landed property – a rare privilege in Singapore! Sentosa Cove is the one exception to the usual restriction on foreigners owning landed properties.

- Commercial Properties: If your interests are more aligned with the commercial sector, you'll be happy to know that there's no restriction on foreigners owning commercial properties. This includes office buildings, shops, and even entire malls. This can be an excellent opportunity for business expansion or investment. If you're an entrepreneur or investor, this could be an appealing option.

- Strata Landed Houses: These are hybrid properties part-condo, part-landed houses that offer a landed experience but are considered part of a larger building complex. Strata landed houses do come with some restrictions, but they're another path to consider.

V. Restrictions for Foreign Property Ownership in Singapore

Despite the opportunities, some limitations exist. Foreigners typically can’t buy landed properties like bungalows, terraced houses, and semi-detached houses outside Sentosa Cove. Some commercial properties may also have restrictions, so always do your due diligence.

VI. Process for Foreigners to Buy Property in Singapore

Buying a property involves several stages:

- Pre-purchase: Engage a property agent to find the right property. Understand the cost – it's not just the property price, but also taxes, agent fees, and more.

- Legal Process: Hire a lawyer to navigate the legal aspects. This will involve understanding the Option to Purchase and the Sales and Purchase Agreement.

- Financial Process: Be prepared to pay the Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD). Securing loans may also be a tad more challenging for foreigners.

- Post-purchase: File the necessary documents and understand the ongoing property taxes you'll have to bear.

VII. Required Approvals for Foreign Property Ownership in Singapore

One can’t stress enough the importance of securing necessary approvals before proceeding with your property purchase in Singapore. Here’s what you need to know:

Residential Property Act’s Approval: If you’re looking to buy a restricted property (i.e., vacant land, landed properties like bungalows, semi-detached and terrace houses, and certain types of apartments), you need to apply for approval from the Singapore Land Authority (SLA) under the Residential Property Act. The SLA generally grants approval if the foreigner makes a significant economic contribution to Singapore.

Landed Property in Sentosa Cove: While foreigners are allowed to buy landed property in Sentosa Cove, you still need approval from the Land Dealings (Approval) Unit (LDAU). The LDAU’s approval is also needed if you’re a foreigner looking to acquire a strata landed house not within an approved condominium development.

Here’s how to go about getting these approvals:

- Applying to the Singapore Land Authority (SLA): You can apply to the SLA by submitting an application form along with necessary documents (like your passport, details of the property, etc.) and a non-refundable application fee. The SLA will evaluate your application based on various criteria, including your economic contribution to Singapore.

- Applying to the Land Dealings (Approval) Unit (LDAU): Similar to the SLA, you would need to fill an application form, submit required documents, and pay a non-refundable fee. Ensure that you check the complete list of required documents on LDAU's official website.

Remember, it’s crucial to not finalize any property deal before you have obtained necessary approvals. Engage a local lawyer to help you understand these processes and to ensure that all your paperwork is in order.

VII. Special Circumstances

There are ways to purchase properties under a company’s name, or via long-term leases. These methods come with their own sets of rules and should be explored carefully.

VIII. Other Things to Consider

Legal advice is invaluable in this process. Additionally, laws may change, and international politics can impact property ownership rules. It’s crucial to keep an eye on these factors.

IX. Buyer’s Stamp Duty and Additional Buyer’s Stamp Duty

Foreigners and Singaporeans alike are obligated to pay the Buyer’s Stamp Duty (BSD) for both residential and non-residential property purchases. Furthermore, residential property acquisitions are subject to the Additional Buyer’s Stamp Duty (ABSD).

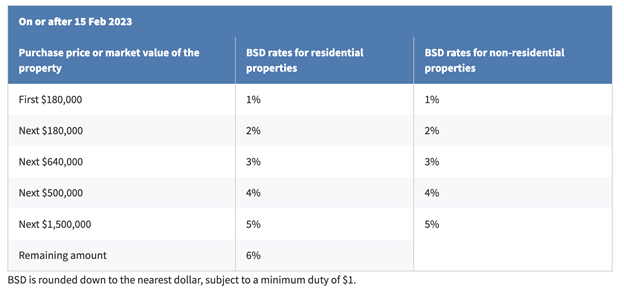

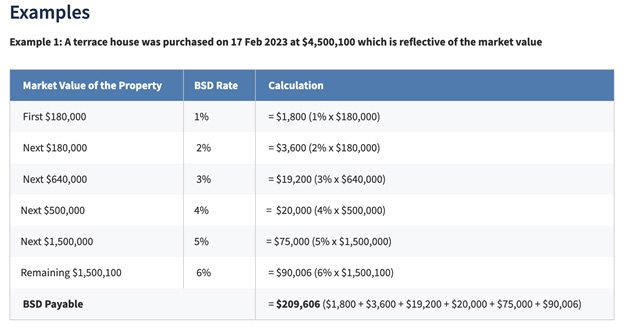

Both BSD & ABSD are calculated using either the purchase price or the market value of the property, whichever is greater. The amount is then rounded down to the nearest dollar, with a minimum duty of $1.

The BSD rates for residential properties are as follows:

- 1% on the first S$180,000

- 2% on the next S$180,000

- 3% on the next S$640,000

- 4% on the next S$500,000

- 5% on the next S$1,500,000

- 6% for the remaining amount.

The BSD rates for non-residential properties are as follows:

- 1% on the first S$180,000

- 2% on the next S$180,000

- 3% on the next S$640,000

- 4% on the next S$500,000

- 5% for the remaining amount

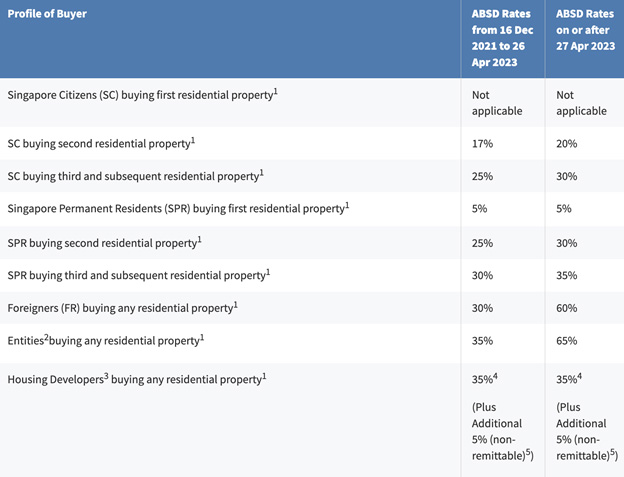

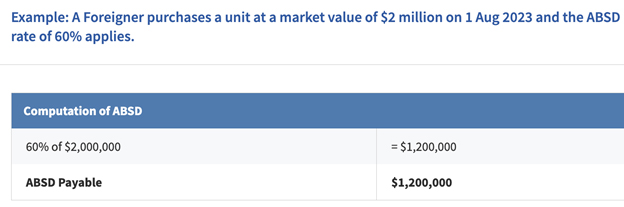

The ABSD rates for residential properties vary based on:

- Your citizenship or residency status

- The number of residential properties you own

Whether you’re an individual, an entity or developer

X. Frequently Asked Questions (FAQs)

Singapore’s political stability, strong economy, and robust property market make it an attractive investment destination. The high-quality education, healthcare, and lifestyle also appeal to many foreigners looking to settle or invest in the region.

No, foreigners cannot own new HDB flats but foreigners who are Singapore Permanent Residents (SPRs) can buy resale HDB flats if they form a family nucleus consisting of two or more applicants who are related by blood or marriage.

Yes, foreigners can buy freehold condos in Singapore without any special approval.

No, there is no limit to the number of private apartments and condos that a foreigner can buy.

Yes, foreigners can buy walk-up apartments in Singapore, as long as they are not classified as landed properties.

Yes, foreigners can buy certain types of residential properties like condos, certain strata landed houses, and landed properties in Sentosa Cove, with some requiring prior approval.

Buying property in Singapore does not automatically grant you PR status. PR applications are evaluated on factors like economic contribution, qualifications, and family ties to Singaporeans.

Yes, but they would need approval from the Land Dealings (Approval) Unit (LDAU) under the Singapore Land Authority (SLA).

Yes, foreigners can buy Executive Condo (EC) in the open market from 11th year of the EC project.

Yes, foreigners can buy cluster housing which is classified as condominiums. Foreigner can also buy other types of strata landed house in an approved condominium development.

This includes vacant land, landed properties such as bungalows, semi-detached and terrace houses, and strata landed houses not within approved condominium developments.

Besides the property purchase price, foreigners need to pay the Buyer’s Stamp Duty (BSD) and the Additional Buyer’s Stamp Duty (ABSD). They also need to pay annual property tax based on the property’s annual value.

Remember, the information provided is as accurate as possible up to the time of writing. Always consult with a property agent, lawyer, or the relevant authorities to get the most up-to-date and specific advice for your situation.

Have more questions? Contact our real estate experts today for free consultation!

XI. Conclusion

Buying a property in Singapore as a foreigner is certainly possible, but it requires a careful understanding of the rules. We hope this guide has been helpful, and remember – always do thorough research!

XII. References and Resources

For further reading, consider visiting the URA’s website or consulting with local law firms or real estate agencies.